(This is a repost of an important article that I originally published on the Ides of March, 2015 when bitcoin traded in the 200s. It’s a “must read” for those interested in understanding why Bitcoin has real, intrinsic value. It proposes the “correct” means of measuring changes in that value over time.)

Valuing bitcoins is a controversial subject. Part of the problem is that traditional valuation tools (discounted cash flows, for example) simply are not helpful when applied to something like bitcoins. Much more on this subject here.

Does this mean that bitcoins cannot be fundamentally or intrinsically valued? I don’t think so.

Starting at the Right Point

Most attempts at valuing bitcoins start at the wrong beginning point. They assume individual bitcoins to be discrete assets distinct from the Bitcoin network itself. Consequently, they attempt to ascertain the value of individual bitcoins by reference or analogy to other discrete assets--usually precious metals, fiat currencies, money, land, etc.—rather than by appraising bitcoins for what they are, the exclusive means of access to the benefits of the Bitcoin network itself.

In some ways bitcoins are analogous to shares of stock. Shares of stock give their owners legal rights to certain benefits of the company (such as a share of the profits), enforceable by courts of law. Similarly bitcoins give their owners certain practical abilities (specifically, accessibility to the Bitcoin network), enforceable by mathematical formulas embedded in the network itself. Just as individual stocks are best characterized as transferable rights of access to, or ownership of, the benefits of a company, individual bitcoins are best characterized as a means of obtaining certain benefits that are only available to those with access to the Bitcoin network.

Top Down, not Bottom Up

The intrinsic value of a share of stock depends ultimately upon the value of the company. We don’t value a share of stock by comparing it, by analogy, to other shares of stock or other assets classes, and then summing the value of all the individual shares to arrive at the value of the company. Doing so gives no consideration to the unique attributes of the company itself (profits, free cash flow, competitive position, etc.).

So, instead, we determine the value of the company, the enterprise itself, and then divide by the number of shares to arrive at a per share value. Each share thus represents a fractional interest in the company’s whole value. Said another way, each share’s value is determined by reference to the whole.

For the same reason that we cannot value shares without determining the enterprise value of the underlying business, we cannot value bitcoins without first referencing the underlying value of the Bitcoin network. The Bitcoin community’s failure to understand this has lead to endless debates over the origins of value (subjective versus objective), whether or not bitcoins are money, the significance of Mises’s regression theorem, etc. These debates resolve themselves once we start from the proper beginning—valuing the network.

How to Value a Network

How to value a computer network has actually been the subject of considerable study.

The world has long recognized that networks in general, and computer networks in particular, have practical use value, and that their usefulness varies primarily with the size of the network as determined by its number of nodes or users. Tiny but useful networks have a tiny (though non-zero) value, while large and useful ones have an exponentially larger value.

Metcalfe’s law (articulated first around 1980 specifically as a tool for valuing networks) teaches that the intrinsic “value”, or usefulness, of a network varies with the square of the number of nodes in the network. Doubling the number of nodes therefore quadruples the network’s use value, because doubling the nodes results in approximately four times as many possible unique connections among them. For Metcalfe, the number of possible connections available on a network was a proxy for its usefulness, and its usefulness was a proxy for its value.

Metcalfe’s Law has been criticized primarily on three grounds. First, in its original form, it simply counted the number of nodes (users) rather than the number of active nodes. Thus it seemingly failed to account for the fact that a large network that is infrequently used (that is, comprised of a great mainly inactive or underactive nodes) may be less useful, perhaps substantially less so, than a smaller network with almost exclusively highly active nodes.

Second, Metcalfe’s formulation assumed that each node/user is to be equally valued, whereas Zipf’s law teaches that this is almost certainly never the case. Zipf’s law implies that the first most active user of a network is likely twice as active/valuable as the second most active user, three times as active/valuable as the third most active user, etc.

Third, application of Metcalfe’s law to large and rapidly growing networks leads to value calculations that are unimaginably, and therefore unrealistically, large (as we will see below).

To remedy these criticisms, commentators, including Metcalfe, have suggested the logic of Zipf’s law requires the use value of a network to vary not in proportion to the square of the number of its nodes (at Metcalfe originally theorized), but rather in proportion to the number of nodes multiplied by the log of the number of nodes [the so-called “n log(n)” valuation metric]. For reasons we shall see, the n log(n) valuation methodology seems to be a preferable method for valuing Bitcoin.

Relative Value Versus Actual Value

Both Metcalfe’s Law and the n log(n) formulation (hereafter collectively called “power law valuation metrics”) purport to tell us the relative value of a network at given points in time based on changes in its number of users/nodes. For instance, if a network with a starting value of “x” doubles its nodes, its value will more than double under each approach, the two approaches varying only their respective estimations of how much more. But, importantly, neither can tell us the actual intrinsic value of a network unless we already know its use value at some given point in time. One needs a starting point value (“x”) from which to extrapolate using the power law valuation metrics. For this, we must rely upon other means, or else simply make some assumptions.

Bitcoin’s “X” Value

Can one calculate a definite value for Bitcoin at some historical point in time (“x”) from which we could then extrapolate past or future values using Metcalfe’s law and/or the n log(n) formation? Perhaps, though doing so is certainly beyond the capabilities of this writer. Even so, we can say a few important things about Bitcoin’s “x” value.

First, we can say with confidence that bitcoin has an “x” value. Even the early Bitcoin network was useful, if only to few knowledgeable insiders at first. It was useful because Bitcoin operates on a first-of-its-kind protocol permitting computer networks to do things never before possible. Specifically, the Bitcoin network allows an unlimited number of people to have equal and full access (administrator level privileges) to a common and accessible database without any of them having the practical ability to alter any entries that came before (at least without being discovered by all users), and without that database being under any party’s centralized control.

To illustrate how this works, suppose that you want everyone in the world (who so desires) to vote anonymously, using his or her computer or smart phone, as to whether or not Pluto should be classified as a planet. Assume further that you want every voter to see every vote (though not who cast it) in real time via the web, and that you don’t want any voter to be able to change a vote previously cast by another (at least not without being discovered by every other voter). How would you accomplish such a thing?

Prior to Bitcoin, there was only one answer: Hire a trusted third party (someone who everyone hopes will not manipulate the vote and who can be trusted to prevent all other voters from doing the same) to host and secure the voting database on its server, and to publish the results in real time.

But introducing this trusted third party adds much risk, complexity and cost. Perhaps the additional risk and cost is not great for something as trivial as voting on the status of Pluto, but what if instead of tracking Pluto votes the third party’s database was expected to track how much money each of us has in our respective bank accounts, and any payments between us?

In that case, concerns that the trusted third party (a bank, let’s say) might not be so trustworthy heighten immediately, right? So much so that we only permit certain third parties (banks and money transmitters, or instance) to act in this capacity, and we require them to obtain very expensive licenses to do so. We further require that such licensees undergo independent CPA’s audits each year, that the CPA’s auditing the bank themselves undergo periodic audits (“peer reviews”), that governmental or pseudo-governmental agencies (like the Comptroller of Currency, the Federal Reserve, the Treasury Department, state banking regulators, etc.) also audit and “regulate” banks, and that these regulators themselves undergo periodic audits (such as by the Governmental Accountability Office). And yet, even that is not enough! As a final measure, we require that an agency implicitly backed by the full faith and credit of the federal government (the FDIC) insure certain bank deposits against our “trusted” third party’s incompetence, theft, or failure to account for them properly.

As a society, we pay handsomely for these “trusted” third party services, and for all the regulation and oversight that goes into to ginning up sufficient public “trust” in them. And, as a society, we are regularly disappointed by them.

Importantly, Bitcoin technology allows us for the first time to hold our Pluto vote, or (once-scaled, as it has now) even securely track people’s account balances, without having to rely on any trusted third party record keeper (or their auditors or regulators) to ensure an accurate accounting. This never-before-possible ability for multiple members of the public to be awarded full administrator’s privileges to a widely-accessible database--without risk of any of them altering prior entries and without having to place that database under the control of a “trusted” and centralized third party to secure it—means that most every trust-based business model—those of trust companies, brokers, exchanges, registrars, escrow agents, clearing houses, money transferors, and banks just to name a few—can now be replicated using inexpensive and freely-available software.

Because the Bitcoin network, though not operated, controlled or managed by any centralized person or entity, is capable of faithfully logging events and clearing transactions in a way that is incorruptible, uncensorable, irreversible, completely reliable, and accessible to all (or at least anyone owning some fraction of a bitcoin), it, or something very much like it, will ultimately do to financial and trust-based intermediaries what the Internet did to book and music stores, the publishing industry, the post office, producers and processors of photographic film, newspapers, classified ads, proprietary telephone networks, etc.

Mises’s Regression Theorum

Being a first-of-its-kind technology with obvious usefulness, even the earliest and tiniest version of the Bitcoin network therefore had a non-zero use value, or “x” value. And because individual bitcoins are absolutely required to make use of the network (they are what give one administrator-level privileges) and are limited in number, they too had a non-zero “x” value (even in the beginning).

This is important to Austrian school economists since, for them, whether or not bitcoin every had an initial use value, and “x” value, bears directly on the issue of whether individual bitcoins will ever trade in the economy as real “money”. The Austrian school of economics teaches that only things that were once useful to some humans (for purely practical reasons) can ever hope to become useful as money. Individual bitcoins satisfy this theoretical requirement since, being the only way one can make entries into the secure Bitcoin database, they have obvious practical use value.

We Don’t Know “X”, So Now What?

We don’t necessarily need to know the Bitcoin network’s starting “x” value to imply its value today, or at any point in time in the past or future. Per Metcalfe’s law and/or the n log(n) formulation (again, I will refer to the two of them collectively as the “power law valuation metrics”), its sufficient that we know its use value at any point in time. For instance, if we knew its value today, we could, in theory, estimate its value as of a year ago or five years ago, or its projected value a year or five years from now, based upon the actual or assumed number of nodes/users at each point in time.

To determine “x” at a given point in time, it’s tempting at first to simply add up the market price of all bitcoins at any given point and proclaim the sum to be the intrinsic use value of the network. However, doing so is problematic for multiple reasons, three of which I will mention here.

First, the market price of an individual bitcoin presumably represents each coin’s proportional share of the expected future value of the network (including its expected future number of nodes), discounted to the present, rather than its proportional share of the network’s current value based simply upon its current usefulness (as approximated by its current number of nodes). The market price (as opposed to its intrinsic value) of any good reflects primarily the market’s discounted expectations of the future rather than simply the circumstances of the present.

Second, because bitcoins are famously volatile, the exact point of time one chooses to measure the value of an individual bitcoin can make a huge difference when extrapolating based upon the power law valuation metrics. For instance, should we determine “x” based upon a bitcoin’s market price in late December of 2013, when each was trading for more than $1,000 per coin? Or today when it’s trading in the mid $200’s?

Third, Bitcoins are increasingly used as a medium of exchange and store of value and may one day be traded as money. Mises’s regression theorem teaches that, once a commodity begins taking on attributes of money, its spending power (exchange value) is no longer limited to its underlying use value as a commodity. Said another way, additional exchange value (purchasing power) attaches by virtue of its new function as money such that the commodity trades at a premium versus its pure commodity use. For instance, gold (as a store of value and medium of exchange) trades at a significant premium versus what it would if we esteemed it only for its uses in industry and for adornment.

The market price of individual bitcoins at any given moment therefore likely includes a premium to account for the digital token’s growing use as a store of value and medium of exchange. Including this “money premium” in the power law metric equations could skew the results improperly (though arguably the adoption of money is itself exhibits network effects that may, in fact, also be described by Metcalfe’s law or the n log(n) formula, as theorized below).

Given the above issues, and others not mentioned, simply adding up the market price of individual bitcoins at a given moment likely tells us nothing about the intrinsic usability/value of the Bitcoin network at that time. Therefore, this practice should be avoided.

We Can Still Play “What If”

Even so, we can still use the power law valuation metrics to have some fun. We can, for example, make certain assumptions about Bitcoin’s value at any given point in time, as well as the future rate of growth in the number of nodes, and then employ Metcalfe’s law or the n log(n) function to guesstimate the network’s implied use value at any other point past or present.

Findings in a recent working paper published by the Division of Research & Statistics and Monetary Affairs of the Federal Reserve Board, Washington, D.C. (available here, p. 17) give us a starting point. The study indicates that the number of unique daily users (UDUs) of the Bitcoin network stood at 100,000 as of “the beginning of 2014” and has doubled every eight months through the three year period ended then.

If we use UDUs as a proxy for active nodes, if we likewise assume the paper’s estimated number of UDUs is reasonably accurate, and if we finally assume that the number of UDU continues to double every eight months into the foreseeable future, then we can easily calculate the Bitcoin network’s implied use value at any point in time using the power law valuation metrics, provided know an “x” value at any point in time.

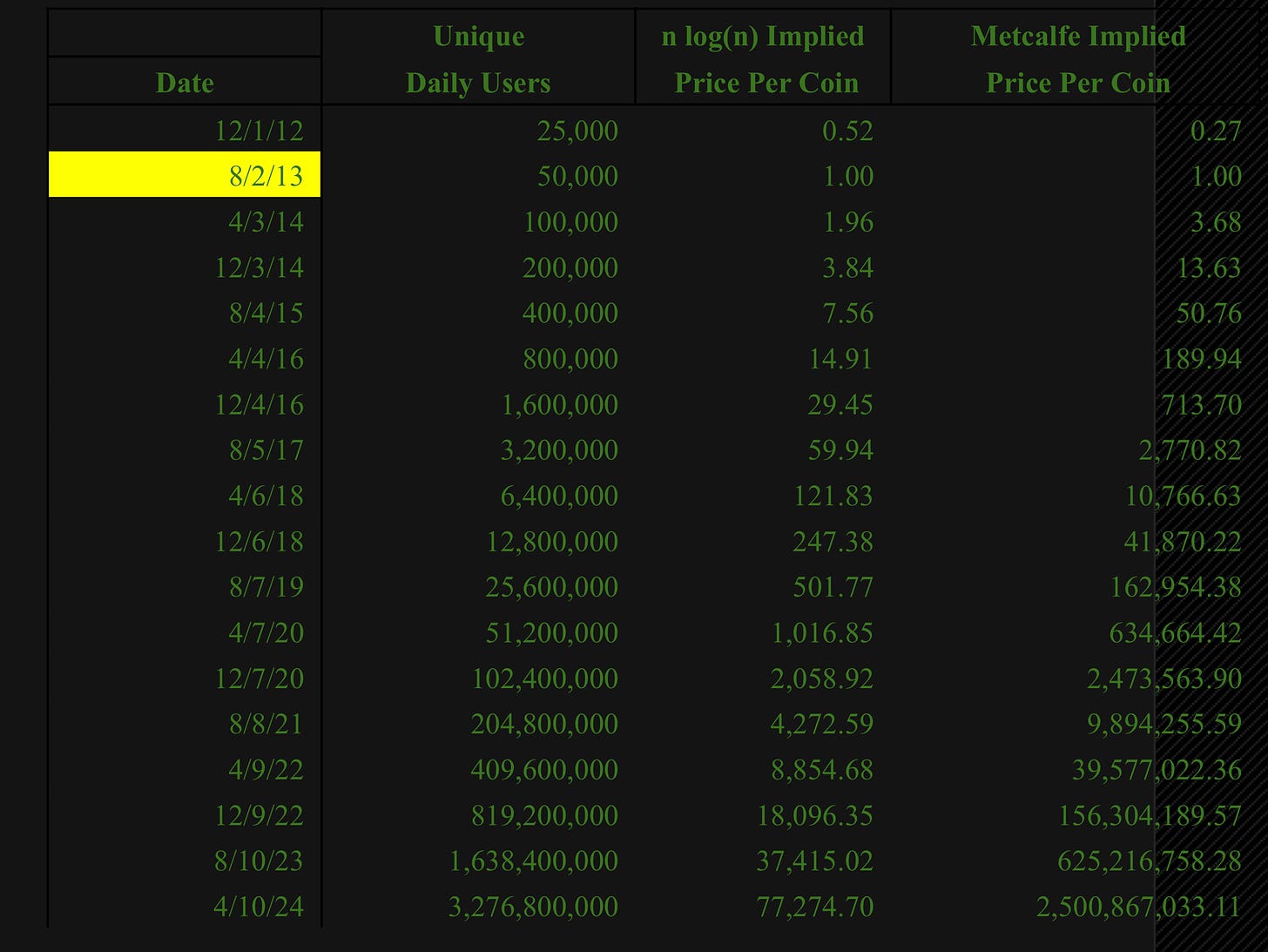

For instance, applying the above assumptions and assigning the network an intrinsic use value of $1,150,000 in early August 2013 (just to pick a number and date), which equates to approximately ten cents per bitcoin at that time, we get the following implied values:

However, by August 2013, the Bitcoin network was already world’s most powerful, with eight times more processing power than the world’s fastest 500 supercomputers combined. Since processing power is what secures the network, the Bitcoin system was by that time incredibly reliable and resistant to attack. Given the network’s unique capabilities, its processing power, and its incredible security, perhaps valuing the network at $1,150,000 in August 2014 is far too conservative.

Consequently, lets assume the intrinsic use value of the whole network was approximately $11.5 million in August 2013, making each bitcoin then worth $1.

Under the same assumptions noted above, we then get implied values as follows:

As previously noted, one criticism of Metcalfe’s law is that the numbers become unreasonably large as the network grows. I suspect that not even Bitcoin’s most avid proponents believe it likely that individual bitcoins will have the purchasing power of over $1 billion by 2024. For this reason and the others noted above, the n log(n) metric is likely the better guide.

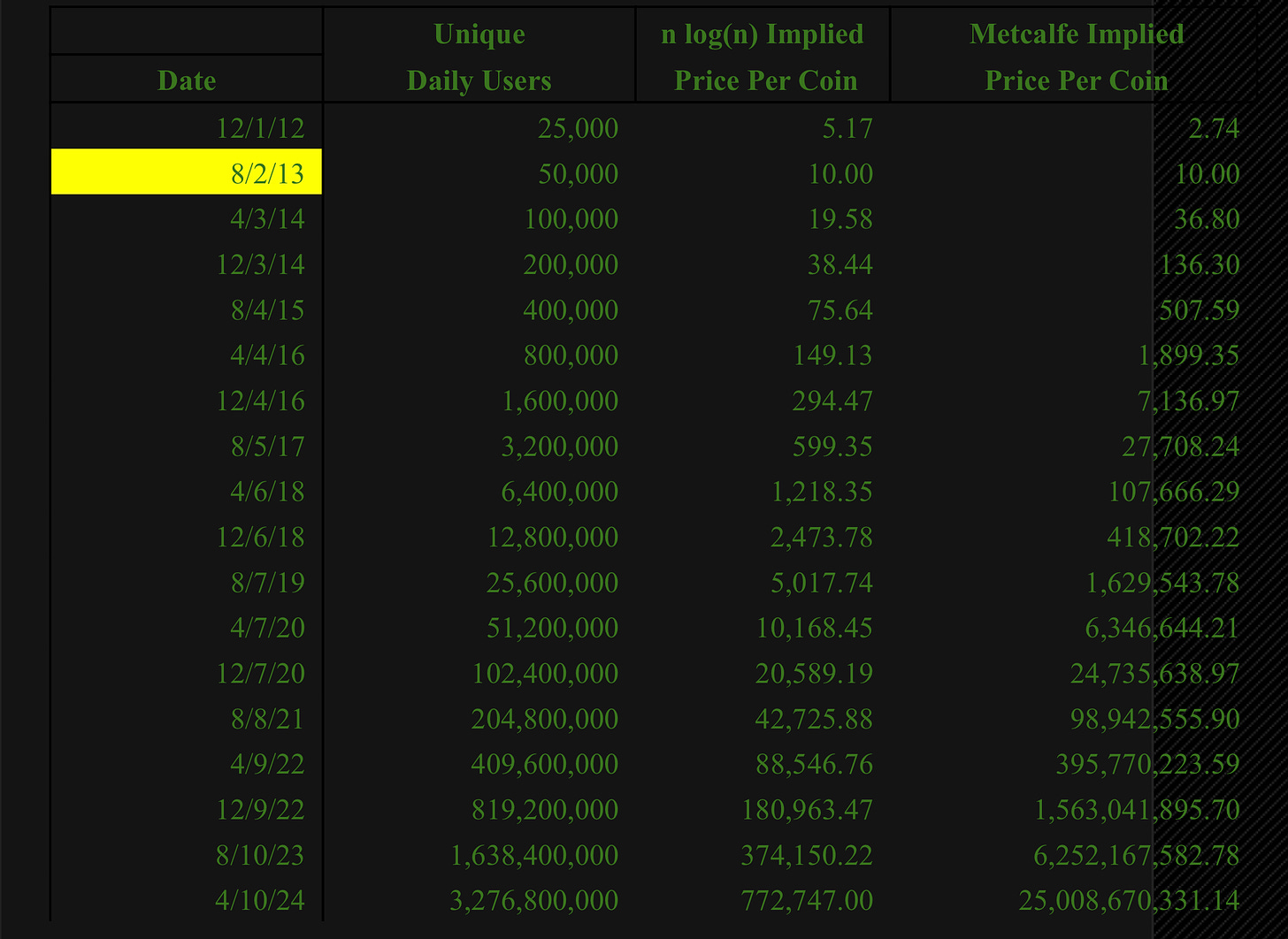

But, perhaps even an $11.5 million intrinsic use value for the whole network in August 2013 is still too low. If we place the intrinsic use value the network at $115 million ($10 per coin) at that time, then we get implied values of:

Notice once again the problem with Metcalfe’s law: A single bitcoin going for $5 billion or more in 2023? Not likely, and perhaps not even possible. By contrast, the implied n log(n) intrinsic value looks much more reasonable.

Side note: Remember that the calculations above are designed to estimate the implied intrinsic use value of the Bitcoin network via application of the power law valuation metrics. They do not account for the fact that individual bitcoins may trade at a substantial premium or discount to these calculated values at any given point in time due to, among other things, speculation, illiquidity, or their increasing use as a medium of exchange and/or store of value.

One Last Thought on Market Prices

I mentioned previously several reasons why extrapolating from the market price at any given moment is potentially unwise and improper. Nonetheless, it’s possible that this view is mistaken, or at least incomplete, for at least two reasons.

First, given Bitcoin’s novel usefulness, it is very likely considered by most to be a “speculative” technology, offering great but highly uncertain and unproven promise. Consequently, the market likely discounts any expectations regarding future growth in users to the present at a very high discount rate. Said another way, expectations regarding the possibility of Bitcoin’s future growth are likely tempered, and perhaps nearly completely offset (via the market-assigned discount rate), by the uncertainty of that growth and “unproven” nature of the technology.

If expectations of future network growth are indeed largely or completely offset by a very high discount rate, then the wild fluctuations in bitcoin’s price over the last year are not so much a function of speculation as insufficient liquidity. Illiquid markets in fixed-supply commodities are notoriously volatile.

Second, focusing on the market price allows us to account for one piece of potentially valuable information that was not considered in my calculations above—each bitcoin’s “premium” over its commodity use value, if any, that results from its increasing use as a store of value and medium of exchange. In other words, if the adoption by the public of new stores of value, mediums of exchange, and/or monies exhibits network effect behaviors consistent with the expectations of one of power law valuation metrics, then it would be appropriate to add this premium to each bitcoin’s underlying commodity value before applying them. Presumably this premium, if any, is reflected in its market price at any given moment.

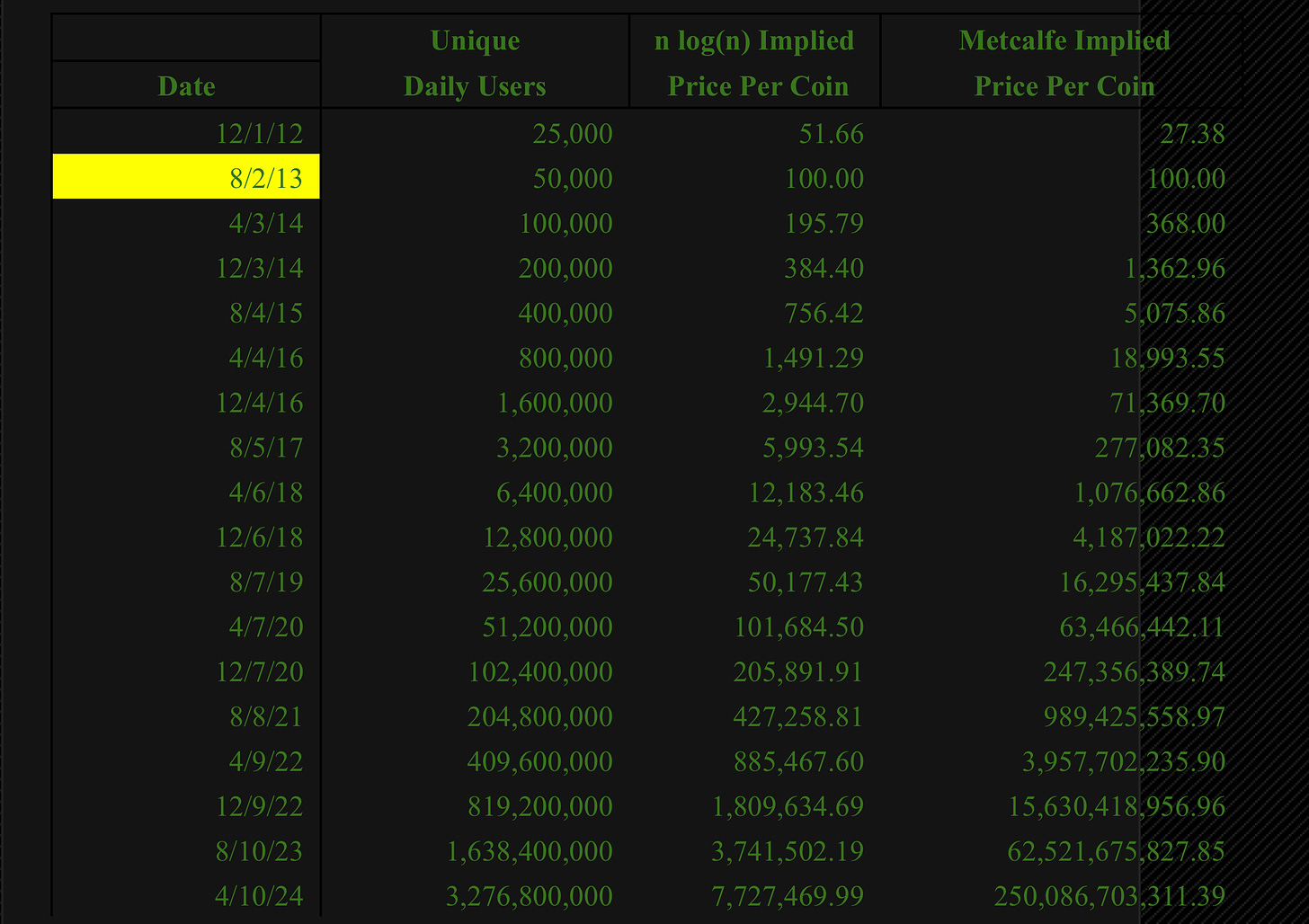

With the above two considerations in mind, consider that each bitcoin traded in the market at about $100 per coin in early August 2013, a fairly stable time in bitcoin’s price history. If we assume use of this price to be a reasonable estimation of its intrinsic use value and value as money at the time, without undue distortions or volatility due to lack of liquidity, then applying the same assumptions as we did in prior calculations, we derive implied values as follows:

Remember, the above calculations are not intended to be predictions of the actual market price of bitcoins at any given point in time and shouldn’t be used for such purpose. Rather, they represent the potential “implied” or “intrinsic” value of the network and currency (expressed on a per bitcoin basis) calculated using Metcalfe’s Law and the n log(n) methodology under the stated assumptions.

Conclusion

Bitcoin is fundamentally a network, and a uniquely useful one at that. Individual bitcoins (or fractions thereof) represent the exclusive means of gaining write-access to the Bitcoin network. Importantly, bitcoins provide such access not as a privilege or right granted by law but rather as a mathematical requirement of the system itself. Without bitcoins, transacting via the bitcoin system is physically impossible.

It’s a tautology to say that useful networks have use value. And because bitcoins are the exclusive means of accessing the unique Bitcoin network and are limited in supply, they too have use value. This demonstrates that bitcoins meet the requirements of Mises’s Regression Theorum.

The two generally-accepted ways of determining the inherent usefulness of a network is Metcalfe’s law and the n log(n) formula (collectively herein called the “power law valuation metrics”). Both indicate that the value of a network is a function of its number of nodes or users, though they disagree as to how much value each additional node adds. Being more conservative and seemingly more realistic, the n log(n) formulation is probably to be preferred.

Both of the power law valuation metrics describe only how much a network’s value varies as a function of changes in the number of its nodes. Neither reveals what the network’s value actually is. To determine actual value, one must make additional assumptions.

By calculating and/or assuming the number of Bitcoin’s users (nodes) each year along with a use value for the network at any given point in time (“x”), we can use the power law valuation metrics to estimate an implied value per bitcoin at any other given time past or present. Results of these calculations, as indicated in this essay, vary wildly based upon one’s assumption of “x” and which valuation metric preferred.

However, despite wild fluctuations in bitcoin’s market price (likely due primarily to speculation and/or illiquidity), the number of unique daily users (nodes) of the Bitcoin network has doubled every eight months for at least the last three years, and the pace of adoption seemingly shows no signs of diminishing. Consequently, both of the power law valuation metrics indicate that the intrinsic use value of the network has grown at an almost steady exponential rate for many years. This suggests that bitcoin’s famous volatility in market price does not adversely impact network usefulness or slow the pace of user adoption.